Share the Love

Sharing the NFT love. It's nearly Valentine's day, after all.

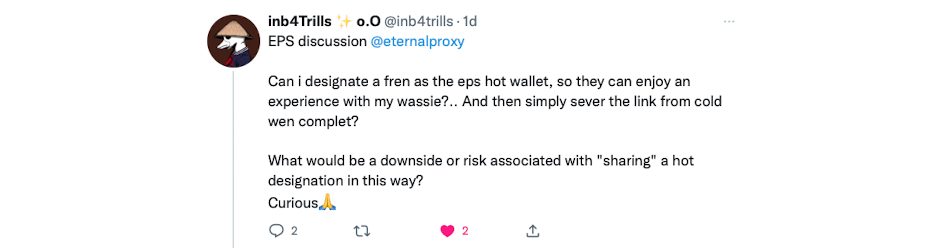

A great question from inb4Trills here:

The short answer is yes! The long answer leads us into EPS's second most important job.

Second-most important?

EPS's top priority is asset safety. It allows users to prove they own on-chain assets without putting them at risk.

But EPS's second job is also important. And is a much more fundamental shift in how we regard crypto assets.

With delegation we allow the separation of owner and beneficiary. I continue to own an asset, with it sitting snug in my cold wallet, while someone else enjoys the benefits which that asset bestows.

This benefit could be as simple as getting access to a community event (like bywassies poker).

This is both straightforward and also a dramatic paradigm shift, one which opens up a whole new horizon of possibilities. We now have a new crypto primitive - the beneficiary - that is distinct from any counter-party that has come before.

The tradfi equivalents are obvious. Have you ever rented a car, or a carpet cleaner, or a movie? You don't own that asset, but you enjoy the use of it during the rental period. Borrowed your neighbours power-drill? The underlying concept is the same.

Most large multi-national industries make heavy use of this model. Actual ownership of income generating capital assets is relatively rare. Airlines lease aircraft, logistics companies lease trucks, farmers lease agricultural equipment etc etc. The user gains beneficial use of the asset while never owning it. There are cash-flow advantages to this, and also some tax perks! (Don't worry, no tax discussion here, I'll do that another time).

Splitting the atom

By splitting benefit from ownership we allow the fun thing that inb4Trills is suggesting. We can lend the benefit of an NFT to a friend with no fear that the asset will be lost. It's still in our wallet.

Projects with large treasuries of their own assets could lend them to people on a 'try-before-you-by' basis, giving people temporary access to gate communities. And yes, benefits can be rented for profit between parties. This is another big step, as it adds a positive cashflow stream to a large number of existing assets.

(Fun aside - you can the first ever EPS rental delegation here: https://etherscan.io/address/0x4feaFcd39978f060013A7596470Ee56FC251cc4f).

The Downsides?

They do exist. The main one is that while lending your friend the benefits of your NFT you can't enjoy those benefits yourself. If you delegate wassie 420 to Ben for use in wassiegames you can't also use the same wassie while the delegation is in place.

This is VERY deliberate. We have been careful that EPS doesn't allow double-dipping. It should NOT be splitting this particular atom. One NFT represents one package of associated rights and benefits. We strongly believe that holders should be able to dispose of those rights and benefits as they see fit, but they shouldn't be able to duplicate them. If the original project has minted 10,000 NFTs there should be, at any given time, a maximum of 10,000 wallets that can enjoy the benefits of holding those NFTs.

Another consideration is that you want to be sure what you are lending your friend! You might want to let them game with your wassie, but if there is an airdrop that happens while you have it delegated you might not want Ben to snap that up, right?

EPS has that covered with a series of usage types (12 is gaming for example, while 2 is airdrops). Until now, people have been delegating usage 1 (all). Shortly we will be rolling out a new viewer app that will guide you through the process of delegating for specific usages.

So you can let Ben play poker, but not get airdrops.

Tax! (all musings, no advice)

I said I wouldn't mention tax, but here's a little teaser to leave you with...

One of the main uses for tradfi lease arrangements is allowing advantageous tax and reporting treatments. It can often be better to borrow an asset than own it. Changes to accounting standards have decreased these benefits over time but they still exist (hit me up if you want to discuss this more. Anyone??).

Anyway - picture this: if you are the beneficial owner of an NFT, what's your tax position? You don't have full control over the asset (far from it) even though you enjoy the benefits it bestows. So how would different jurisdictions view this arrangement, in terms of your reporting obligations and liabilities? And what if the owner of the asset was in a different jurisdiction altogether, maybe in a wallet controlled by an overseas trust?

I don't have definite answers to any of these questions, but I find it interesting to consider a scenario where native crypto assets are able to be held by (owned in the wallet of) a trust, with beneficiaries delegated from that trust in a way that can be trustlessly interpreted by apps and dapps (as EPS allows).

If you don't have full control of that asset, has there ever been a taxable event?

As always, stay safe out there.